About Deduction for Donations

Up to Roughly 50% of Your Donations will be Refunded

As NPO Florence is a certified nonprofit organization (NPO) approved by the Tokyo Metropolitan Government, donations made to NPO Florence by taxpayers in Japan are eligible for tax benefits (deduction for donations).

In the case of individuals, up to roughly half of the donated amount will be refunded.

Please check the deduction system and procedures before making a donation.

In the case of corporate donations, please refer to here.

In the case of donation by will and inheritance donations, please refer to here (Available in Japanese only).

How to Receive Deduction for Donations

Make a donation

As NPO Florence is a certified NPO approved by the Tokyo Metropolitan Government, donations made to NPO Florence are eligible for tax deductions.

Receive a receipt

NPO Florence will issue a receipt for your donation.

You will need the donation receipt to file your final tax return (Step 3). Donation receipts cannot be reissued as a rule, so please keep it with care.

File a final tax return

To receive a deduction for donations, you must file a final tax return.

Please note that you cannot apply for a deduction through the year-end tax adjustment.

Receive a deduction for donations

By filing a final tax return, you can receive an income tax refund and a deduction on your resident tax.

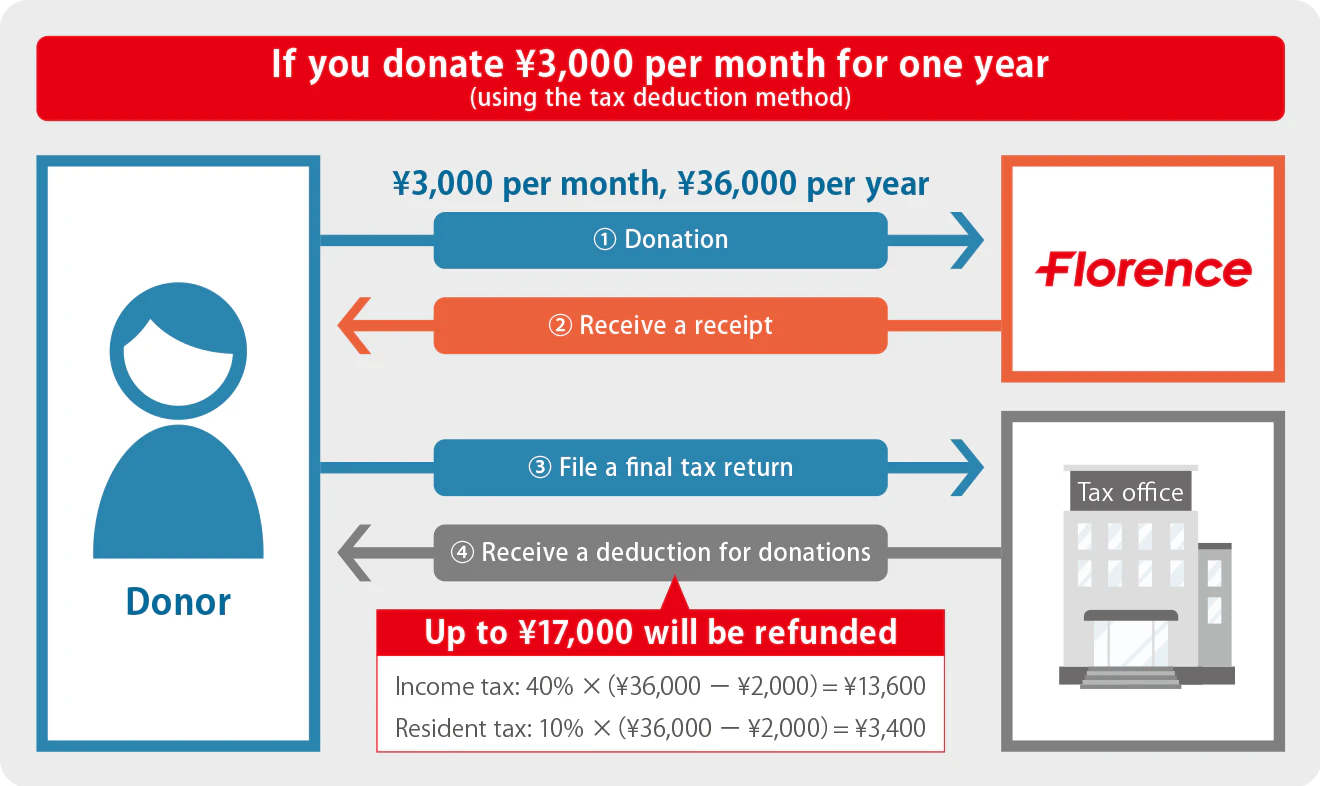

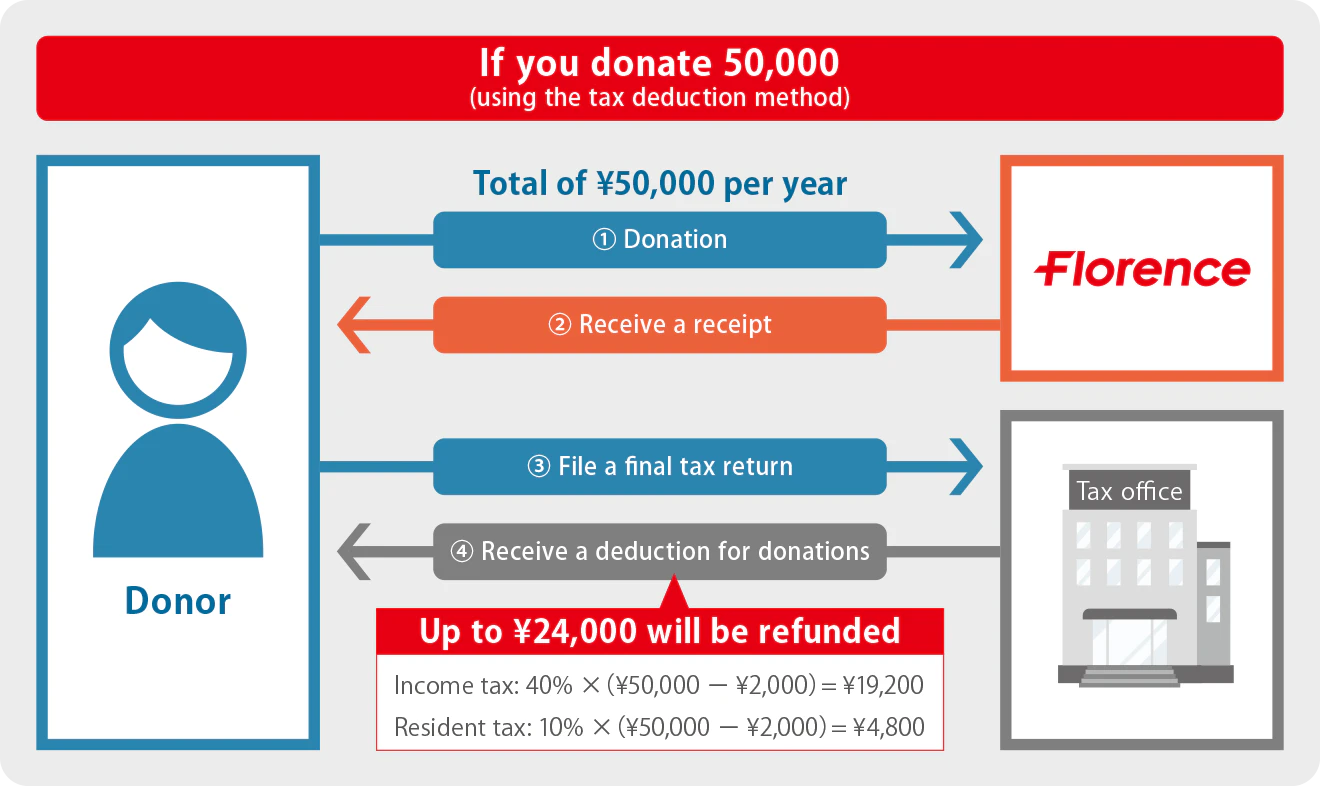

How Much Will be Refunded?

Donations to NPO Florence are eligible for tax benefits (deduction for donations) by filing a final tax return.

Income Tax Deduction

You can choose either the “tax credit method” or the “income deduction method,” whichever is more advantageous to you. In most cases, the” tax credit method” results in a larger refund.

Resident Tax Deduction

If your local government ordinance specifies that donations to NPO Florence are eligible for deduction for donations, you can receive a deduction on your individual resident tax.

The amount of deduction for donations varies depending on your income and the municipality in which you live.

The following chart shows an example of the amount of deduction.

Note:

If your income tax rate is high, you may be able to receive a larger refund by choosing the income deduction method. For more information, please contact your local tax office.

If you live in Tokyo, donations to NPO Florence are eligible for prefectural resident tax deductions. For other prefectures and municipalities, please contact your local government office to find out whether donations are eligible for resident tax deductions.

About Donation Receipts

Receipt Issuance Period

We issue receipts once a year listing all donations made to NPO Florence during the calendar year (through December 31). We mailed to the registered address between late January and early February of the following year.

If you prefer to receive a receipt after each donation, please make a request through the contact form.

Date of Receipt, Address, and Name printed on Receipts

Date of Receipt (date printed on receipts)

・For donations made by credit card or Amazon Pay, the date of payment is the date of receipt.

・For donations made by bank transfer, the date NPO Florence receives the donations is the date of receipt.

Address and Name

Receipts can be issued only to the name registered at the time of donation. If there is change in your address or name, please notify us through the contact form.

Note:

As a rule, receipts cannot be reissued.

If you moved to a new address during the previous year, you can still use a receipt with your old address for filing a final tax return.

About Final Tax Returns

You can obtain the final tax return forms from your local tax office or create them through the National Tax Agency website.

Submit the completed final tax return form along with your withholding slip and donation receipt to your local tax office.

Filing period is from mid-February to mid-March every year.

Refunds will be remitted to your bank account around April if there are no issues with your filing.

For further information, please contact your local tax office.

How to Donate

Translation : Tokyo YWCA International Language Volunteers (ILV)